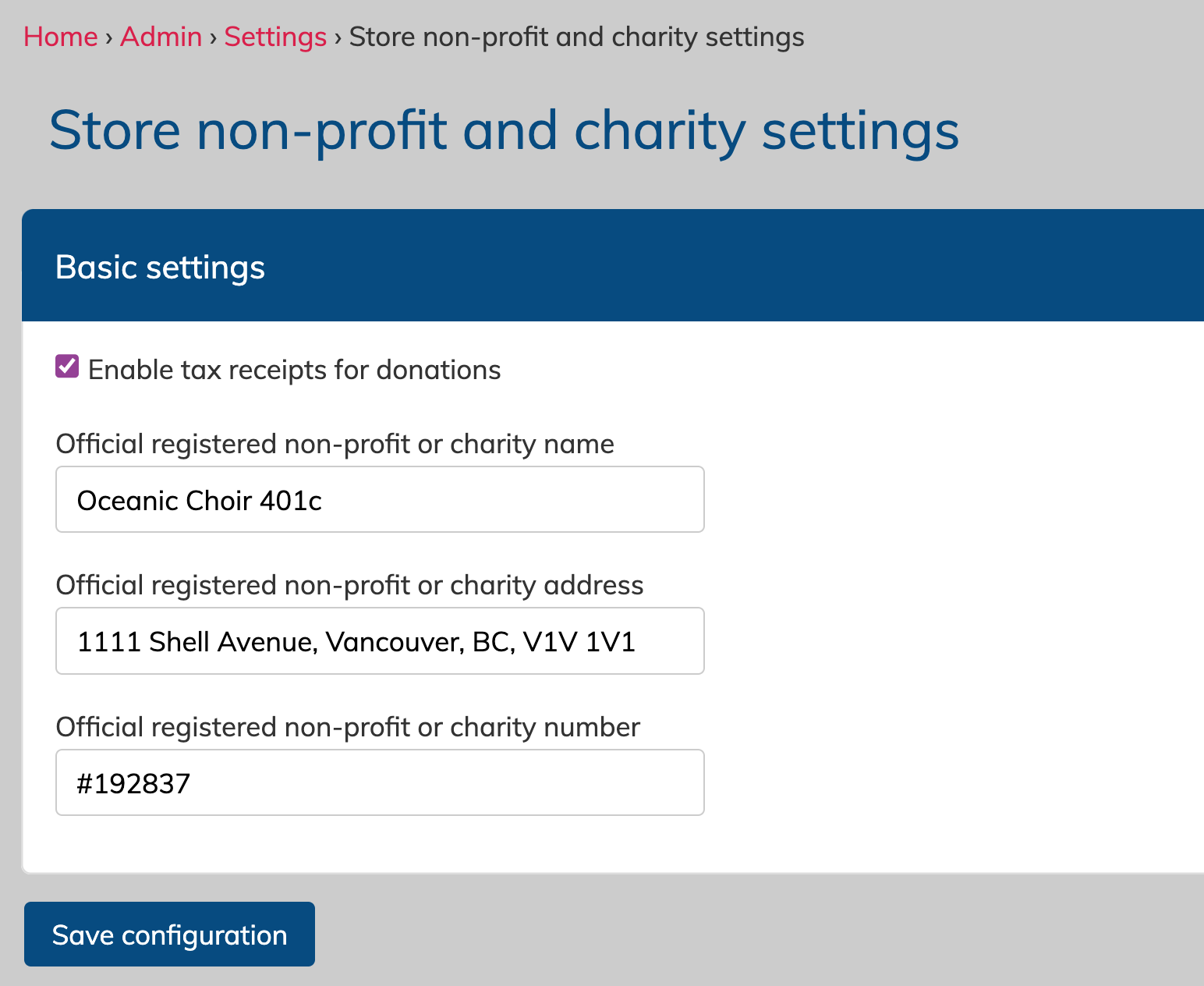

Enable and disable tax receipts for donations

To enable or disable tax receipts for donations, navigate to the the "Store non-profit and charity settings" page in the "Admin settings & tools" area.

Checkmark the enable option, and then fill in the information in the fields below for your organization. This information will be copied into all emailed receipts containing a donation-type product.

During the checkout process

During the checkout process, your purchaser will be asked for their address if they do not already have an address attached to their profile, and their cart contains a donation-type product.

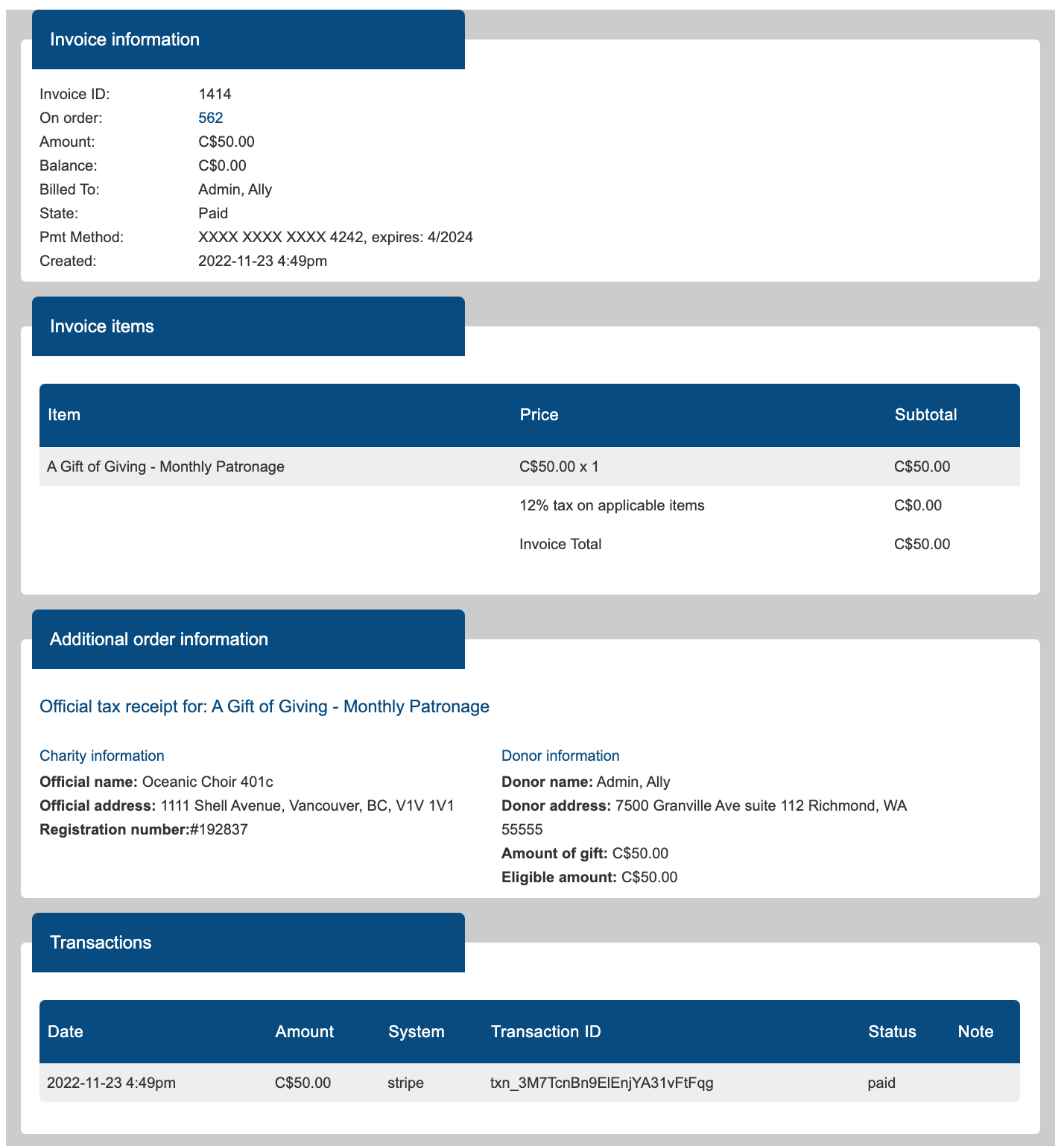

After order confirmation

After their order has been confirmed and payment accepted, your purchaser will receive an emailed invoice receipt. If their order contains a donation-type product, there will be an extra section labelled "additional order information" which will include the name of the donation product, your non-profit/charity details, and their name, email and address, as well as their donation amount.